Defiant Fed boss says Trump won’t make him quit

Image copyright Reuters

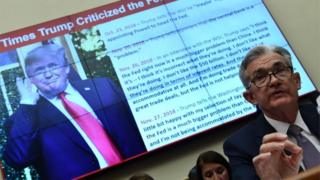

Image copyright Reuters The world’s most powerful central banker has brushed off criticism from Donald Trump, saying he would not step down if the US president asked him to.

Federal Reserve chairman Jerome Powell told a hearing in Washington: “The law gives me a four-year term and I fully intend to serve it.”

Mr Trump has criticised the Fed for not cutting interest rates.

But the president could soon get his wish, as Mr Powell also hinted at a cut soon to bolster the US economy.

Mr Powell is giving evidence to the House of Representatives Financial Services Committee, the first of two days of testimony on Capitol Hill.

He and the Fed have faced sustained criticism for not cutting rates, which Mr Trump blames for unnecessarily slowing the US economy. “Our Federal Reserve doesn’t have a clue!” was one of the president’s tweets.

Asked at Wednesday’s hearing if Mr Powell would step down if requested, he replied “no”. Pressed on whether he thought the president did not have the authority to remove him, he said: “What I have said is the law gives me a four-year term and I fully intend to serve it.”

Disagreement over interest rate policy could ease, however, as Mr Powell signalled that a cut could come soon in remarks that sent the S&P 500 surging past 3,000 points for the first time and prompting a fall in the dollar.

He told the committee that “uncertainties about the outlook have increased in recent months”. Although he expected continued US growth, he warned of economic weakness in other major economies, and a downturn in business investment driven by trade war worries.

“Concerns about the strength of the global economy continue to weigh on the US outlook,” Mr Powell said.

“Apparent progress on trade turned to greater uncertainty, and our contacts in business and agriculture reported heightened concerns over trade developments.”

The comments come despite last week’s strong US jobs figures and an easing of trade tensions with China.

Analysis by Andrew Walker, BBC economics correspondent

As ever in a Federal Reserve Chair’s remarks, there was no commitment to cut interest rates.

But the emphasis on economic uncertainties and below target inflation suggests an increasingly high probability that the Fed will do just that.

The concerns he raised included weaker momentum in some foreign economies which could affect the US. He also mentioned “government policy issues that have yet to be resolved”.

His reference to trade developments was partly about the tension between the US and China. But there was one item on this list that isn’t for the US to address- Brexit.

He didn’t spell out the reasons, but the fact that he flagged it up indicates a concern that the UK’s departure from the EU might have an adverse impact on the US economy.

The Fed has kept its current benchmark overnight interest rate in a range of between 2.25% and 2.50% since December. Mr Powell had first opened the door to a rate cut in comments made last month.

“Powell is setting it up, certainly for a July rate cut,” said Jack Ablin, chief investment officer at Cresset Capital.

And Briefing.com analyst Patrick O’Hare said Mr Powell’s comments “gave the market what it was looking for”.

The financial markets are indicating that the Fed at its 31 July meeting will cut interest rates by 25 basis points, although some analysts have seen the possibility of a larger cut.

His appearance on Capitol Hill comes at a sensitive time for both the Fed and Mr Powell personally, with President Donald Trump lashing out in a series of tweets for not cutting interest rates and needlessly slowing the economy.

At the same time, some blame Mr Trump’s own policies, in particular higher tariffs and his unpredictable approach to policymaking, for increasing the economic risks.