Global PC shipments grew for the fourth quarter and entire year

Following downturns in years past, PC shipments rose in 2019 during the latest quarter and the full year, according to both Gartner and IDC.

PC vendors can thank Microsoft’s 2020 support cutoff of Windows 7 for healthier demand of their products in 2019.

As companies were racing to upgrade their operating systems and computers last year, PC shipments rose during the final quarter and the entire year compared with 2018. Both Gartner and IDC pegged a rise for the latest quarter, though the numbers differed.

SEE: Choosing your Windows 7 exit strategy: Four options (TechRepublic Premium)

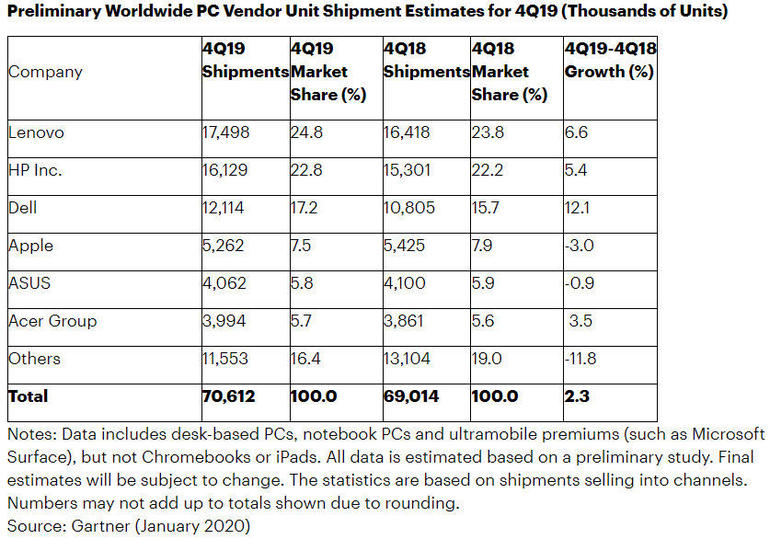

Worldwide PC shipments hit 70.6 million in 2019’s fourth quarter, a gain of 2.3% from the same quarter in 2018, according to preliminary results from Gartner. For the year, shipments shot past 261 million, eking out growth of 0.6% growth from 2018.

IDC’s preliminary results for PC shipments painted a brighter picture, citing a gain of 4.8% for the fourth quarter and growth of 2.7% for the full year with annual shipments hitting 71.7 million.

Gartner’s data includes desktop PCs, notebooks, and ultramobile premiums (such as Microsoft Surface) but not Chromebooks or iPads. IDC’s stats include desktops, notebooks, workstations, and Chromebooks but not tablets or x86 Servers.

Gartner

IDC

The increase in shipments for 2019 marked the first full year of PC growth since the market rose by 1.7% in 2011, according to IDC.

Shipments of desktops and laptops have typically declined over the past several years, hit by a preference for mobile devices and an effort by organizations to cut costs by holding onto existing machines.

But with Microsoft cutting off extended support for Windows 7 on Jan. 14, 2020, many businesses were forced to migrate toward Windows 10, creating a need for new PCs.

“The PC market experienced growth for the first time since 2011, driven by vibrant business demand for Windows 10 upgrades, particularly in the U.S., EMEA, and Japan,” Mikako Kitagawa, senior principal analyst at Gartner, said in a press release.

“We expect this growth to continue through this year even after Windows 7 support comes to an end this month, as many businesses in emerging regions such as China, Eurasia and the emerging Asia/Pacific have not yet upgraded.”

PC shipments grew in the face of certain challenges. A shortage of Intel CPUs placed some constraints, but shipments were ultimately helped by the adoption of AMD processors, according to IDC.

An easing of trade tensions and an improvement in certain industry drivers aided results for the latest quarter.

“Contrasted against the ongoing weakness in consumer PC demand, business PC demand has led to unit growth in five of the last seven quarters,” Kitagawa said.

“The ongoing Intel CPU shortage, which began mid-last year, became a major issue again on PC delivery to enterprise customers by the top three vendors. Without this shortage, shipments would have grown faster than the reported results.”

In the US, PC shipments for the fourth quarter grew by 4.6%, according to Gartner, and by 4.8% according to IDC. Only two of the top vendors saw a decline in U.S. PC shipments, compared with four in the fourth quarter of 2018, Gartner said.

“The fourth quarter is typically a strong buying season for small and midsize businesses (SMBs) that want to maximize their spending before the tax year ends,” Kitagawa said. “The relatively stable economic conditions in the U.S. compared with previous quarters, coupled with the end of Windows 7 support, also loosened up spending on PCs.”

Among the top PC vendors, Lenovo took first place for both the quarter and the full year, followed by HP, Dell, and Apple. Gartner gave the fifth spot to Asus, while IDC bestowed that ranking on Acer Group.

Both Gartner and IDC gave Lenovo a market share of 24.8% for the fourth quarter with HP a close second.

Outside the Asia/Pacific region, Lenovo saw year-over-year growth in shipments throughout the world. In the US, Lenovo’s desktop PC shipments jumped more than 30% compared with the prior year, according to Gartner.

On the downside, the PC market could face certain obstacles ahead.

“Despite the positivity surrounding 2019, the next twelve to eighteen months will be challenging for traditional PCs as the majority of Windows 10 upgrades will be in the rearview mirror and lingering concerns around component shortages and trade negotiations get ironed out,” Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers, said in a press release.

“Although new technologies such as 5G and dual- and folding-screen devices along with an uptake in gaming PCs will provide an uplift, these will take some time to coalesce,” Ubrani said.

Gartner forecasts a continuous drop in the consumer PC market over the next five years but believes that growth could be sustained through more innovative products.

“We’ve already started to see this through the ‘foldable laptops’ introduced at CES this past week along with initiatives that make PCs as easy as smartphones by allowing users to always be connected and ensuring a worry-free battery life,” Kitagawa said.

“Such innovations that change user behavior and create new product segments are something to keep an eye on in 2020 and beyond.”

Also see

Image: Matt Elliott/CNET