Bitcoin ETF Wave: Navigating Crypto Opportunities & Risks

Bitcoin ETF Wave: Navigating Crypto Opportunities & Risks

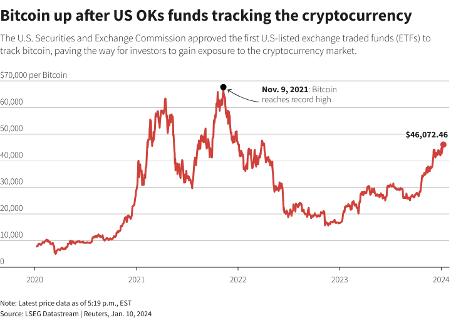

The impending SEC approval of a spot Bitcoin ETF promises transformative possibilities. A potential shift towards direct Bitcoin ownership by institutional investors looms large, presenting the prospect of a reduced market supply. However, as historical trends caution, major launches often usher in post-event price adjustments.

The ETF Wave and Institutional Interest

The approval of a spot Bitcoin ETF signals a significant embrace of crypto by the traditional finance sector. The move underscores the growing recognition of the merits inherent in digital assets, particularly Bitcoin (BTC) and Ethereum (ETH).

Read more: SEC’s stance on Bitcoin ETFs

“Bitcoin ETFs could open floodgates to $30 trillion wealth management market” – CNBC

ETF Managers’ Strategic Approach

ETF managers, astute in their strategies, won’t merely pay retail prices for BTC or ETH. Instead, they embark on a process to acquire these assets at a discount to their expected future prices. This dynamic introduces a compelling narrative of creating upward price pressure in new market segments while influencing options and futures products tied to digital assets.

Explore insights into ETF managers’ strategies

U.S.-listed bitcoin exchange-traded funds (ETFs) saw $4.6 billion worth of shares trade hands on the first day, according to LSEG data, as investors jumped into the landmark products approved by the U.S. securities regulator.

Metafide’s Role in Navigating Market Dynamics

At Metafide, we stand at the forefront of monitoring market behaviors, providing real-time insights. In a landscape defined by rapid fluctuations, our platform empowers investors to navigate the intricate dance between supply, demand, and volatility in the wake of significant market events.

Discover how Metafide aids in real-time market insights

Seizing Opportunities Amidst Market Volatility

As the ETF wave unfolds, institutional demand for these funds intensifies. However, individual asset holders face a critical decision point – whether to hold or abandon assets as prices surge. Metafide becomes an indispensable tool in this context, offering data-driven decision support for navigating the volatile nature of the market.

The Inclusive Nature of Crypto

While the ETFs offer convenient avenues for exposure to crypto assets, it’s crucial to remember that crypto is for everyone. The very essence of crypto empowers individuals to become their own custodians. Holding one’s keys may involve responsibility and risk, yet it provides an alternative to relying solely on ETF offerings.

Explore alternative ways to acquire and hold crypto assets

The imminent Bitcoin ETF wave ushers in a new era, blending traditional finance with the dynamic crypto landscape. Metafide emerges as a beacon for investors seeking clarity amidst the evolving market dynamics. As the crypto narrative unfolds, the decentralized and inclusive nature of these digital assets remains a cornerstone, reminding investors of the myriad ways to participate in this ground-breaking financial paradigm.

About Metafide:

Metafide (https://www.metafide.io) is a crypto asset trade strategy, rating, prediction and analytics tool. Metafide analyzes macroeconomic factors affecting the crypto ecosystem in real-time (including Sharpe ratio, volatility, inflationary impact, and token metrics). We evaluate whale concentration risk, exchange performance, and blockchain utilization in everything we do, and apply that to help our clients acquire, arbitrage and derisk digital assets.

About the Author:

Frank Speiser is an experienced executive, team builder and product builder with multiple successful exits and a deep technical understanding. A developer since an early age, Frank has always believed it is important to work with the technologies used in building the products around us in order to empathize with the users and understand what is valuable and what truly benefits the people interacting with them.