Mini-budget: Tax cuts for millions set to be unveiled

Kwasi Kwarteng will borrow billions to boost growth and limit the impact of soaring bills …

By Ben King

Business reporter, BBC News

Published

3 hours ago

Image source, Getty Images

Image source, Getty ImagesChancellor Kwasi Kwarteng will later unveil a mini-budget with National Insurance and corporation tax cuts.

Details of cuts to other taxes such as stamp duty may also be announced as the government tries to limit the impact of soaring energy bills on households.

Experts expect it to be the biggest tax-cutting event for 34 years.

Labour said funding these tax cuts by borrowing would leave people paying more for longer.

However, the government hopes the tax cuts will boost the economy, increase its revenues and prevent a massive increase in the national debt.

What could be in the mini-budget?

The government has confirmed it will let people keep more of their earnings by cutting National Insurance (NI).

Other measures could include:

- scrapping a planned increase in the amount of tax companies pay on their profits

- possible cuts to other taxes, including stamp duty which is paid on house purchases

- ending the cap on bankers’ bonuses

- tightening the rules around universal credit

- plans to boost economic growth, such as creating low-tax zones around the UK

The announcements will be made by new Chancellor Kwasi Kwarteng, who is in charge of the public finances.

The tax-cutting plans under consideration could cost at least £30bn.

Will there be a stamp duty cut?

There is speculation that the government may cut stamp duty, a tax paid when people buy a property in England and Northern Ireland.

No tax is paid on transactions up to £125,000, and from there it rises in bands to a maximum of 12% for the portion over £1.5m. It raises around £12bn for the Treasury.

The government is thought to be considering a cut, to help first-time buyers and house moves, which would boost economic growth, according to the Times newspaper.

How will National Insurance change?

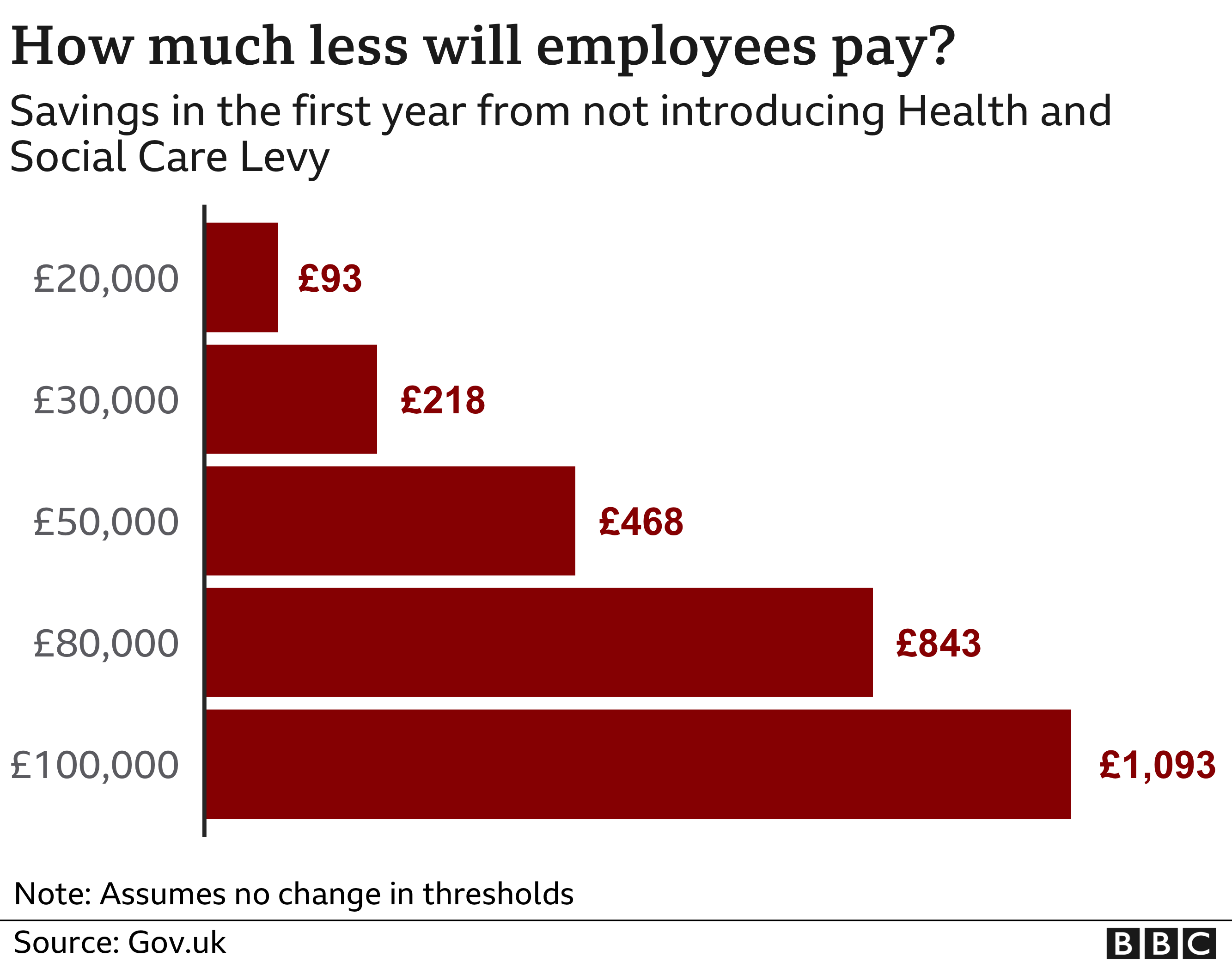

NI was set to return to its old rate from April 2023 – to be replaced by a new Health and Social Care Levy at a rate of 1.25%. The levy will now not be introduced.

The NHS will still get the funding it was promised, but government is now expected to borrow the money rather than raise it from tax.

High earners will benefit most, as they pay the most NI. An NI cut won’t help pensioners or those on low income or benefits because they don’t pay the tax.

Which other announcements are expected?

Corporation tax

This tax is based on the annual profits that a company makes.

However, Ms Truss is set to cancel the rise.

Green levies

These charges fund schemes like insulation and renewable energy.

The prime minister has promised to temporarily scrap the levies, saving households about £150 each.

Income tax

A possible cut on the main tax on people’s earnings could also be on the cards.

Universal credit

Mr Kwarteng is expected to announce a welfare shake-up to “get Britain working again”.

This is set to include universal credit, a benefit payment paid to working-age people.

How does the government plan to boost growth?

The mini-budget could also see an end to the cap on bankers’ bonuses. This was introduced across the EU in 2014 (when the UK was still a member) following the global financial crisis. Under the current rules, a banker’s bonus cannot be higher than their annual salary – unless shareholders agree.

When asked if she would be happy to see bankers getting bigger bonuses, Ms Truss said she wanted to see a growing economy.

The government may also announce the creation of “special investment zones”. Certain locations could be allowed to relax planning rules and reduce business taxes to encourage investment.

Can the UK afford to tax less and borrow more?

Critics, including Ms Truss’ Conservative leadership rival Rishi Sunak, argue immediate tax cuts will require the government to borrow more.

The money, plus interest, will eventually need to be paid back by taxpayers.

However, Ms Truss argues tax cuts will help the economy grow – bringing in more money which will cover the cost of the amount borrowed.

Why is it being called a mini-budget?

Major decisions about tax and spending are normally made twice a year – in an autumn Budget Statement and a Spring Statement.

The Office for Budget Responsibility (OBR) – which gives independent advice to the government – normally publishes its own analysis of these statements. It sets out the cost of new policies, how much tax will be raised and what it means for the economy.

However, the government is refusing to publish the OBR’s assessment alongside the mini-budget.

The Treasury said it “remain[s] committed to maintaining the usual two forecasts in this fiscal year, as is required”.

An update on the timetable for the next OBR forecast will come during Friday’s statement.

A full-scale Budget is expected later this year, but no date has been set.

What are your questions on the cost of living crisis? What would you like to know about the chancellor’s mini-budget? Email your questions to: haveyoursay@bbc.co.uk.

You can also send your questions in the following ways:

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at YourQuestions@bbc.co.uk. Please include your name, age and location with any submission.